Talk To - call (909) 682-8108

Work with a Certified Fire Your Landlord® Mortgage Expert Today!

Call or Text at - (760) 477-4394

What is Fire Your Landlord® ?

What is a Certified Fire Your Landlord® Mortgage Expert?

"The power behind the VA loan comes from a handful of significant financial benefits not typically found in other mortgage types."

VA loans are one of the most powerful mortgage options on the market for Veterans, active military and surviving spouses.

The power behind the VA loan comes from a handful of significant financial benefits not typically found in other mortgage types. These advantages compared to different loan options are a big reason why VA loan volume has grown considerably over the last 15 years.

Let's take a deeper look at the most significant VA loan advantages. 👇

1. No Down Payment

By far, the single-largest benefit of the VA loan is that qualified Veterans can purchase without a down payment. This huge advantage allows Veterans and service members to buy homes without having to spend years saving for that typical lump-sum payment.

2. No Private Mortgage Insurance

Private mortgage insurance (PMI) is insurance that protects lenders in case of a borrower default. Many conventional lenders require borrowers to pay private monthly mortgage insurance unless they can put down at least 20 percent, which is challenging for many Veterans. Conventional borrowers will need to pay this monthly fee until they build 20 percent equity in the home.

3. Competitive Interest Rates

Here’s another big way the VA loan program saves Veterans money: Having the lowest average fixed rates on the market.

VA loans have had the lowest average 30-year fixed rate on the market for the last six years, according to data from ICE Mortgage Technology.

VA interest rates are typically 0.5 to 1 percent lower than conventional interest rates. Lower rates help Veterans save every month and over the life of their loan.

4. Relaxed Credit Requirements

Since the Department of Veterans Affairs only oversees the loan program and does not issue loans, the agency does not set or enforce credit score minimums.

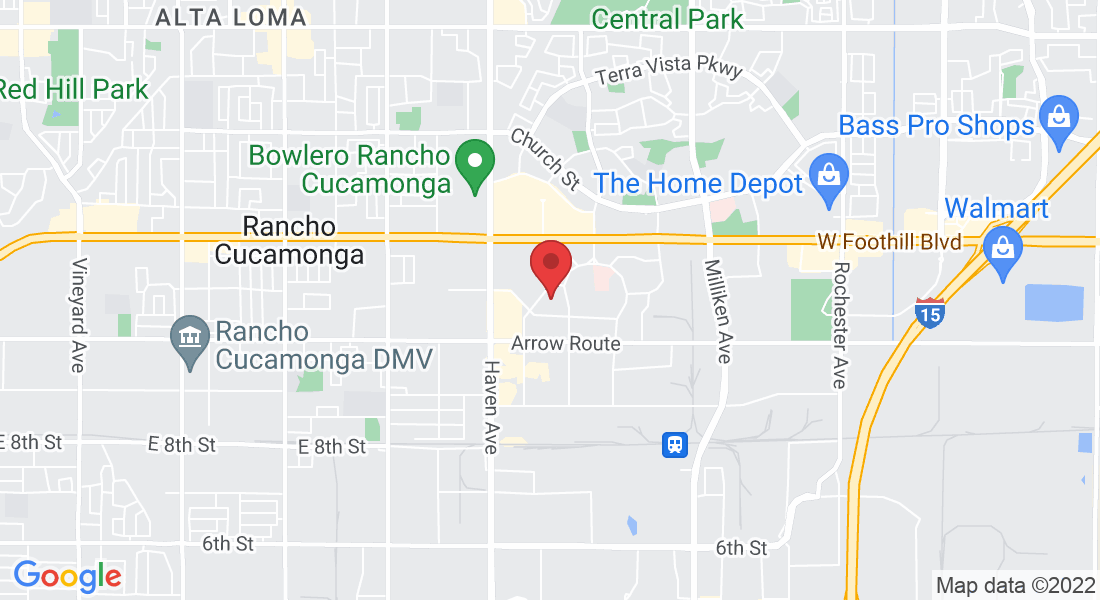

Click on the Red Marker in the map to get turn-by-turn directions to my office.

5. Closing Cost Limits

All mortgages come with fees and closing costs, but the VA actually limits what Veterans can be charged when it comes to these expenses. In fact, some costs and fees must be covered by other parties in the transaction. These safeguards help make homeownership affordable for qualified homebuyers.

6. Lifetime Benefit

One of the most common misconceptions about the VA mortgage program is that it's a one-time benefit.

Veterans who qualify for a VA loan can use this program over and over again, and the benefit never expires. Unlike what you may have heard, you don't necessarily have to pay back your VA loan in full to use your benefit again.

7. No Prepayment Penalties

With some types of loans, paying off a home loan before it matures results in a pre-payment penalty. This is because lenders miss out on additional opportunities to collect interest payments. The prepayment penalty is a way for financial institutions to recoup some of that money.

The VA loan allows borrowers to pay off their home loan at any point without having to worry about a prepayment penalty.

8. Foreclosure Avoidance

VA loans are one of the safest loans on the market and have been for more than a decade. That's pretty remarkable considering that about 8 in 10 homebuyers don't put any money down.

The VA mortgage program has emerged as a safe harbor for several reasons, including the VA's residual income guidelines. The VA has also done a tremendous job advocating for Veterans in jeopardy and working to ensure they stay in their homes.

The VA guaranty program isn't just about getting Veterans into homes. It's also focused on helping Veterans keep them.

9. The VA Appraisal

The VA appraisal is a required step of the homebuying process to assess the property’s value and condition. The appraisal serves two purposes: establish an appraised value for the home and ensure the home meets the minimum property requirements.

Establishing an appraised value verifies the home is priced at “fair market value.” This means the home is priced similarly to houses of the same size, age and location. The VA appraisal gives borrowers peace of mind that their home was purchased at an appropriate price.

It might be easier to get pre-approved for a mortgage than you ever imagined. We believe in making it as easy as possible for everyone to purchase their own home. Click here now to get started, it only takes a few minutes online.

Brett Stacy

14075 Hesperia Road

#108 Victorville , CA, 92393

(909) 682-8108

It might be easier to get pre-approved for a mortgage than you ever imagined. We believe in making it as easy as possible for everyone to purchase their own home. Click here now to get started, it only takes a few minutes online.

Want more

GREAT Info like this?

Brett Stacy

Mortgage Expert

Get a personalized and successful home loan approval experience

See how much you qualify for in 60 seconds or less.

Follow Us on Social Media

Loan Resources

Brett Stacy,

Living life by design.

© 2022 Options Pro Marketing, Fire Your Landlord®, and All Rights Reserved.

Please Click Here to access main realtor or lender website or refer to www.nmlsconsumeraccess.org to see where is a licensed lender and servicer.

Options Pro Marketing and its associated brands (Fire Your Landlord®) are marketing entities that partner with lenders and are not lenders themselves. All lending questions should be directed to our partner lenders ( Brett Stacy of ). A pre-approval does not constitute a loan commitment or guarantee of a loan. Pre-approval is subject to a satisfactory appraisal, satisfactory title search, and no meaningful change to borrower's financial condition.

This is not an offer for extension of credit or commitment to lend. All loans must satisfy company underwriting guidelines. Not all applicants qualify. Information and pricing are subject to change at any time and without notice. The content in this advertisement is for informational purposes only. Products not available in all areas. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. is an Equal Housing Lender.

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here